Market watch

Can Asian economies thrive with a hawkish Fed and strong USD in 2023?

Issue date: 2022-12-30

J.P. Morgan Asset Management

As we progress through the current hiking cycle, it is apparent the Fed still sees a bigger risk in hiking too little than in overtightening. As the path to a soft landing in the U.S. gets narrower, investors are naturally also concerned about collateral damage. Historically, a hawkish Fed has generated a number of headwinds for Asian economies, which has translated to weak asset performance. As pressures continue to mount, investors want to know if (1) Asian economies can withstand further pressure from a hawkish Fed and a stronger USD and (2) which economies are most vulnerable.

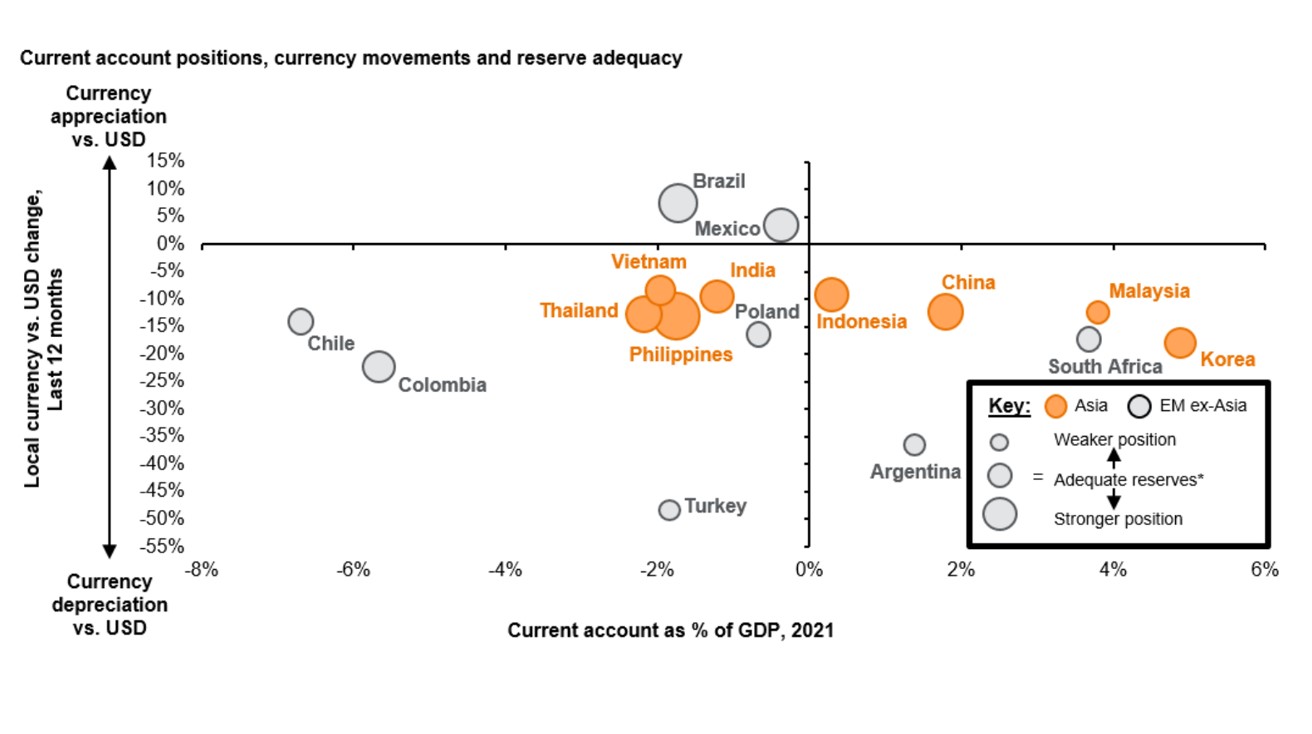

To make that assessment, we look at a range of indicators across key categories such as foreign exchange (FX) reserve coverage, indications from balance of payments and imminence of FX funding needs, as well as overall leverage measures.

Accelerated declines in FX reserves sparked concerns as central banks intervened to stem excessive currency volatility. However, most economies in Asia still have a healthy level of reserves. The situation in Malaysia and China appears to be the most precarious, but we note that the risk of domestic deposit outflows is lower in economies that have a history of effective capital controls. Hence, relying on indicators that just look at the extent of FX reserves coverage versus potential domestic money supply outflows may not be as relevant.

In terms of the current account balance, most Asian economies still have a flat to positive current account as a percentage of GDP. This is true especially for those that gained from goods (China, South Korea, Taiwan) and commodities (Indonesia, Malaysia) exports. India, Thailand and the Philippines, on the contrary, are running deficits due to cost of imports and a decline in tourism. However, tourism trends have been on the mend and commodity prices have come off their peaks.

Real rate differentials have declined but still remain positive across most Asian economies except for Thailand. Debt levels are quite elevated in economies such as China, South Korea and Thailand, but most of the debt is domestically held and in the local currency. This suggests the risk to a rapid stop in external funding is low.

Our assessment shows that while there has been deterioration in external indicators across some Asian economies, there still exists a reasonable buffer to withstand further pressures.

*Adequate reserves are stocks of a market’s foreign exchange reserves that can cover 3 months of imports (the amount of times available reserves can cover 3 months’ worth of imports) and cover short-term debt due in the next year (the amount of times available reserves can pay off debt maturing in the next 12 months and any payments on longer-term debt due in the next 12 months). The larger the bubble, the larger the amount of reserve coverage.

Guide to the Markets – Asia. Data reflect most recently available as of 14/11/22.

Will China’s economic recovery benefit Asia?

The COVID-19 resurgence and stringent containment measures continue to weigh on China’s economic growth in 2022. These economic challenges will prompt authorities to gradually relax the current COVID policy in 2023. The pre-conditions for this transition would be a higher vaccination rate, especially among the elderly, and for the health care system to be well prepared for an increase in the number of infections. Limiting severe cases and deaths would be an important justification for the government to relax its policy.

Recent data showed that economic activity in China was mainly supported by manufacturing and exports. With the escalation of stimulus measures, the strong momentum of infrastructure construction may be sustained through 2023. In contrast, consumer sentiment remains subdued, and sluggish consumption growth has weighed on overall economic performance. Meanwhile, real estate investment and housing activity have been further depressed by weak consumer confidence. This all points toward the fine-tuning of pandemic control measures as essential in restoring consumer and corporate confidence, and in enhancing the efficacy of policy stimulus. If this happens in the spring of 2023, the synergy between reopening and continued policy stimulus may help stabilize domestic growth and benefit other Asian economies via trade and tourism channels.

Given its pivotal role in regional trade, China’s recovery could provide some fresh momentum in Asia’s demand, especially at a time when the U.S. and European economies are slowing. During lockdowns, consumers in China became more cautious and saved more. Hence, the import of goods slowed to 3.5% year-over-year in the first 10 months of 2022, compared with 31.4% for the same period a year ago. This is partly the reason for weakness across the electronics supply chain, particularly in semiconductor demand for Korea and Taiwan.

The pent-up demand in China has significant potential. Chinese households are holding RMB 116.5trillion in deposit accounts, 42% higher than the pre-COVID-19 level. Should this demand be released as the economy reopens, the spillover effects to other Asian economies would be a welcome source of growth.

Service trade is another channel for positive regional benefits. In 2019, Chinese tourists spent USD 254.6billion in overseas travel, and Asia is a major destination. This expenditure shrank to USD 105.7billion in 2021 and declined sharply again in 2022 due to even stricter border controls. In addition to tourism, there is potential demand for overseas education, health care and financial services. On the current low base, China’s reopening could present opportunities for service sectors across Asia. That said, based on the current gradual easing of pandemic measures, a full recovery is likely only in late 2023.