Market watch

Generate income through diversified sources

Issue date: 2023-03-31

Franklin Templeton

Franklin Templeton believes the investment environment during 2023 promises to provide much greater potential for yield and total return than we saw at the turn of 2022. In our analysis, locking in attractive yields through duration is the best way to achieve income goals, while investing in fixed income assets at attractive prices should deliver robust returns if rates fall and spreads narrow due to looser Fed policy.

The US Federal Reserve’s (Fed’s) singular focus on controlling inflation during 2022 resulted in an aggressive cycle of rate rises, which in turn tightened financial conditions, leading to a sharp rise in yields and spreads on fixed income assets.

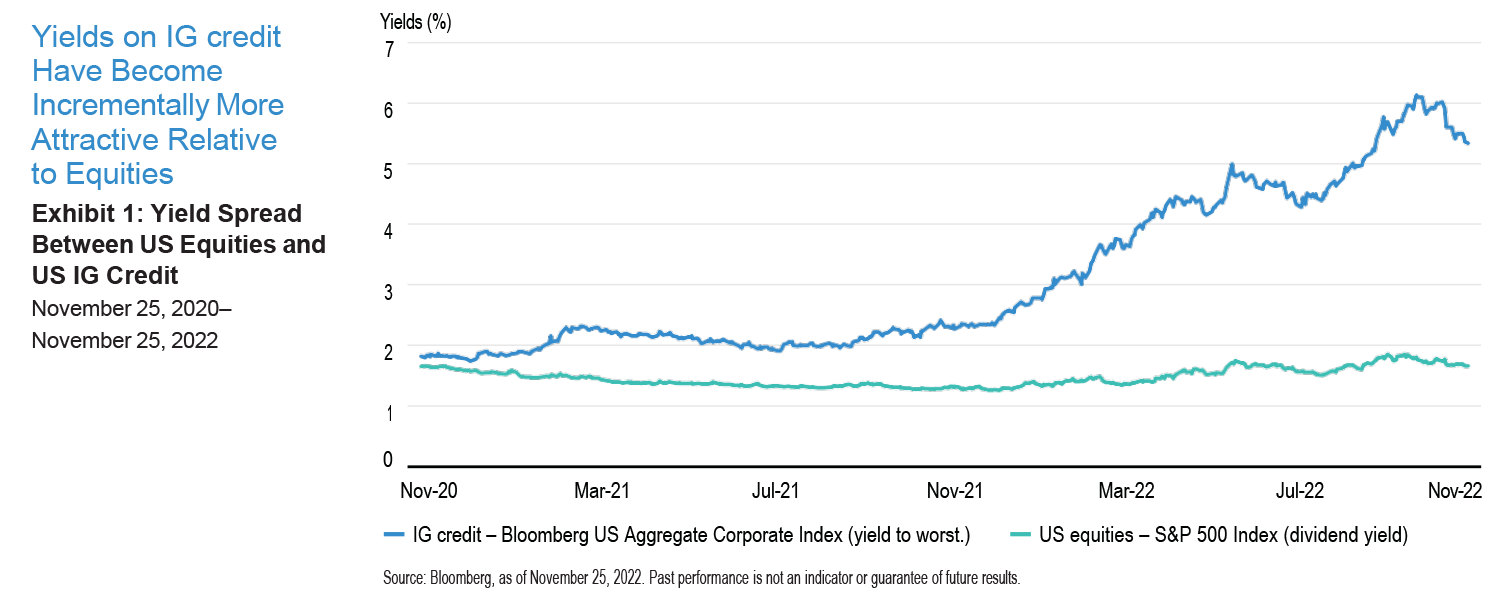

However, the investment landscape heading into 2023 is very different to 12 months ago. We believe the move higher in rates is likely almost done. High-quality credit and bonds are expected to offer better total return potential than equities (refer to exhibit 1), while the positive correlation with equities is also breaking down, allowing fixed income to offset equity market volatility.

Improved total return potential within fixed income

Allocation within the fixed income asset class depend upon where markets go. In a positive economic scenario, we believe investment-grade credit has the potential to make double-digit returns as rates move lower and spreads narrow, while they should also outperform other risk assets should fundamentals deteriorate. If investment-grade (IG) corporate bond yields move back toward 6%, this type of fixed income can be an attractive asset class to consider.

However, our assessment of US Treasuries has also improved as interest rates have risen, given they currently offer attractive yields and downside protection should a recession increase equity market volatility. When 10-year Treasury yields were around 2% they were less attractive but extending duration to lock in yields at 4% is much more compelling from an income perspective.

Elsewhere, the HY bond sector is, in our view, more resilient than many investors believe, absent a significant negative impact on corporate earnings. Most HY issues won’t need to be refinanced in the next few years, and therefore a recession in 2023 with a modest pullback shouldn’t be a big concern. As a result, while the investment community focuses on whether spreads are wide enough to justify a move into credit, we see opportunities at current yields, which have shot up to levels not seen for 15 years.

Managing equity uncertainty

We still see opportunities for selective investment in equities to maximize yield and total return while navigating increased volatility. For equities to rally, we believe it would take a favorable trajectory around inflation and economic growth, while earnings would also need to remain relatively robust. We would also want to see the Fed pause rate hikes, move into a position to normalize rates, and get back to a neutral setting. Alternatively, there could be further downside for equities if the economy feels the impact of tightening in 2023 and earnings suffer.

Apart from equities, we believe equity-linked notes (ELNs) offer a way to manage this uncertainty. ELNs enable investors to derive income from exposure to equities that offer little or no dividend and can be used in conjunction with common stocks to access both yield and price upside potential. These instruments can also be used to manage volatility and hedge exposure.

Diversification is the key

We believe the investment environment during 2023 promises to provide much greater potential for yield and total return compared to 2022. Locking in attractive yields through duration is the best way to achieve income goals, while investing in fixed income assets at attractive prices should deliver robust returns if rates fall and spreads narrow due to looser Fed policy. We believe higher-quality bonds offer significant downside protection should a recession is to happen. At the same time, broad equity exposure remains important should an improvement in economic sentiment trigger an equity market rally.

Important Information Copyright © 2023. Franklin Templeton. All rights reserved. Franklin Templeton Investments (Asia) Limited is the issuer of this document. The comments, opinions, and estimates contained herein are based on or derived from publicly available information from sources that Franklin Templeton believes to be reliable. Franklin Templeton does not guarantee their accuracy. This document is for informational purposes only. Any views expressed are the views of respective portfolio management team of Franklin Templeton as of the date published and may differ from other portfolio management team/ investment affiliates or of the firm as a whole. The security provided (if any) is for illustration purpose only and is not necessary indicative of a portfolio's holding at any one time. It is not a recommendation to purchase, sell or hold any particular security. This document is not intended to provide investment advice. Investment involves risks. Where past performance is quoted, such figures are not indicative of future performance. The underlying assumptions and these views are subject to change without notice. There is no guarantee that any forecasts expressed will be realized. This document has not been reviewed by the Securities and Futures Commission in Hong Kong. Neither Franklin Templeton, its affiliates nor any officer or employee of Franklin Templeton accepts any liability whatsoever for any loss arising from any use of this document or its contents. The information in this document is confidential and proprietary and may not be used other than by the intended user. This document may not be reproduced, distributed or published without prior written permission from Franklin Templeton. |