Market watch

Fixed Income Outlook: Stormy Weather and Silver Linings

Issue date: 2022-12-30

AllianceBernstein

2022 has been a stormy year for bond investors, and the forecast calls for more of the same.

The Storm: Global Slowdown, Stubborn Inflation

Rising prices continue to confound expectations that slowing global growth will ease inflation pressures. While the US Federal Reserve and other central banks are aggressively hiking rates to combat inflation, most drivers of today’s high inflation are outside of central banks’ control. The Russia-Ukraine conflict and the pandemic continue to disrupt fuel, food and goods supply chains, feeding high inflation and throttling global economies.

Sticky inflation may compel central banks to tighten monetary policy still further, which increases the potential for a global recession. In turn, fear of recession is leading investors to take refuge in the US dollar, the world’s reserve currency. As their own currencies tumble, other countries feel the pain of both the strong dollar and higher interest rates. Emerging-market (EM) countries are especially vulnerable, since their sovereign debt is often issued in US dollars; when the dollar strengthens, their debt burden increases. Financial market turbulence may be here to stay for some time.

The Silver Lining: Higher Yields

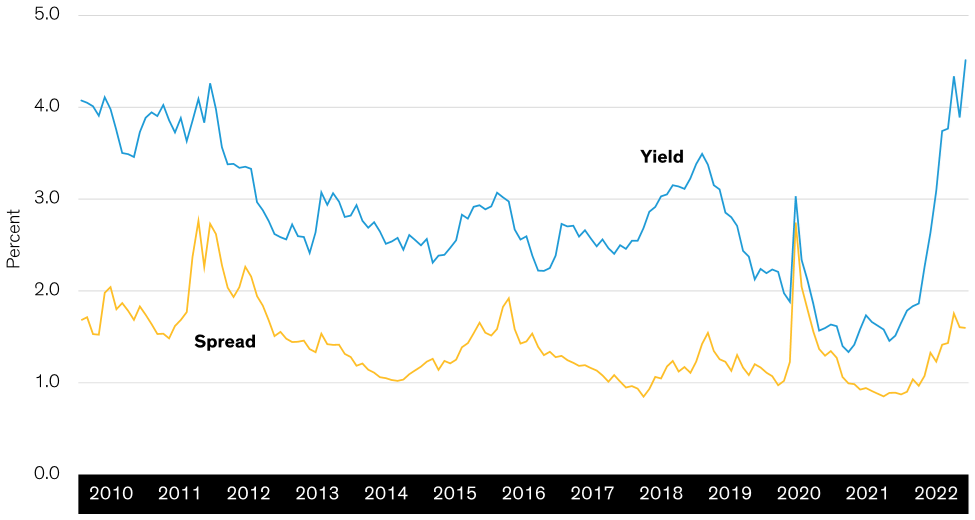

The risk of recession is contributing to market volatility and episodic liquidity challenges, but it’s also creating opportunity. Investment-grade corporate yields and spreads are at multiyear highs (Display).

Investment Grade Corporate Bond Yields Are at a 10-Year High

Bloomberg Global Aggregate Credit Index: Yield-to-Worst and Option-Adjusted Spread

The specter of a recession usually scares investors away from corporate debt. Credit fundamentals tend to have weakened prior to any slowdown, causing issuers to enter a downgrade and default cycle as growth and demand slow further. But today’s situation is different.

Today’s issuers are in better shape financially than issuers entering past recessions. The corporate market went through a default cycle just two years ago when the pandemic hit. The surviving companies were the strong ones—and they’ve managed their balance sheets and liquidity conservatively over the past two years, even as profitability recovered. Thus, we expect defaults and downgrades to rise only to average levels over the next year.

Meanwhile, today’s higher yields signal higher potential returns ahead. For example, the high-yield sector’s yield to worst has been a reliable indicator of high-yield return over the following five years.

In fact, high-yield bonds performed predictably through the global financial crisis, one of the most stressful periods of economic and market turmoil on record. During that period, the relationship between starting yield and future five-year returns held steady, thanks largely to bonds’ consistent income stream.

Four Strategies for Surviving and Thriving

Below are some tips on how active investors can rise to the challenge in today’s environment.

- Be nimble

We expect heightened volatility and liquidity challenges to persist. Active managers should be ready to take advantage of quickly shifting valuations and fleeting windows of opportunity as other investors react to headlines.

- Seek (inflation) protection

Because inflation is likely to remain elevated for some time before it falls back to target, explicit inflation protection, such as Treasury Inflation-Protected Securities and CPI swaps, can play a useful role in portfolios.

- Lean into higher-yielding credit

Yields across risk assets are much higher today than they’ve been in years—an opportunity investors have been waiting a long time for. “Spread sectors” such as investment-grade corporates, high-yield corporates and securitized assets, including commercial mortgage-backed securities and credit risk–transfer securities, can also serve as a buffer against inflation by providing a bigger current income stream.

- Choose a balanced approach

Global multi-sector approaches to investing are well suited to a quickly evolving landscape, as investors can closely monitor conditions and valuations and prepare to shift the portfolio mix as conditions warrant. Among the most effective active strategies are those that pair government bonds and other interest-rate-sensitive assets with growth-oriented credit assets in a single, dynamically managed portfolio.

This approach can help managers get a handle on the interplay between rate and credit risks and make better decisions about which way to lean at a given moment. The ability to rebalance negatively correlated assets helps generate income and potential return while limiting the scope of drawdowns when risk assets sell off.

For now, we encourage bond investors to fix their eyes on the horizon. By taking a longer view, investors can avoid overreacting to today’s headlines—even as they shift tactically to capture opportunities that arise when other investors overcorrect.

Important Information The information contained here reflects the views of AllianceBernstein L.P. or its affiliates and sources it believes are reliable as of the date of this publication. AllianceBernstein L.P. makes no representations or warranties concerning the accuracy of any data. There is no guarantee that any projection, forecast or opinion in this material will be realized. Past performance does not guarantee future results. The views expressed here may change at any time after the date of this publication. This document is for informational purposes only and does not constitute investment advice. AllianceBernstein L.P. does not provide tax, legal or accounting advice. It does not take an investor's personal investment objectives or financial situation into account; investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer of solicitation for the purchase or sale of, any financial instrument, product or service sponsored by AllianceBernstein or its affiliates. Investment involves risks. This document has not been reviewed by the Securities and Futures Commission. The issuer of this document is AllianceBernstein Hong Kong Limited (聯博香港有限公司). ©2022 AllianceBernstein L.P. The [A/B] logo is a service mark of AllianceBernstein and AllianceBernstein® is a registered trademark used by permission of the owner, AllianceBernstein L.P. |