Promote the importance of early investment

While customers are well aware that long term investment is key to future financial stability, they often delay acting on it.

Our job is to help them see what the real effect will be on their final pot, giving them the jolt they need to start saving for the future. Sometimes the best tool at our disposal is hard evidence.

By providing some examples of the potential ramifications of delaying setting up an investment programme, you might be able to give them a push in the right direction.

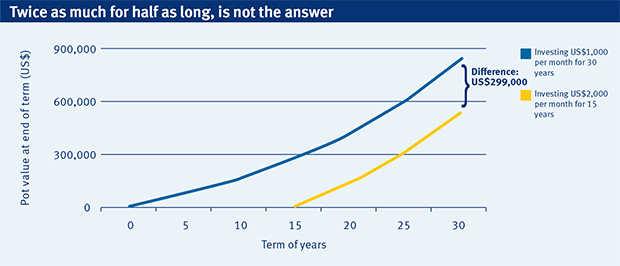

For instance, if customers invest US$ 1,000 a year for 30 years, they could end up with US$ 835,000. Putting this off for 15 years, and investing double the amount to make up for lost time - US$ 2,000 each month for the next 15 years – will still result in a smaller final pot.

Important notes: Pot values quoted assume an annual growth rate of 5% over the periods indicated. These figures are indicative only and not based on an actual investment. There is no guarantee of the annual growth rate. You will be subject to investment and market risks.

Despite the sacrifices they’re likely to make in order to put away such a large sum, the pot could be worth US$ 536,000, almost a third less than if they had started saving earlier.

The same can be seen over the course of a 25 year investment programme. By saving US$ 1,000 every month over 25 years, the final amount could stand at US$ 598,000. If customers wait five years before embarking on the same investment programme, 20 years later the pot might be worth only US$ 412,000. That’s 2/3 the amount it could have been if they’d started at the right time.

Using your expertise and examples such as the above, customers are more likely to understand how much of a loss they’ll suffer by putting off investment decisions now.

Assure them that while you understand how many commitments are vying for a percentage of their pay cheques, investing over a long period of time pays off. And there’s an important benefit in the short term: without having to worry about being strapped for cash in the future, they’ll enjoy the money they have left to spend now even more.

Long term investment and the future happiness of our customers is at the core of Standard Life’s business.