Coming into their own

Emerging market (EM) corporate bonds, rare issuers until a decade ago, have now firmly become part of the investment landscape.

Kieran Curtis

Investment Director, Emerging Market Debt, Standard Life Investments

Diverging fortunes

Rising debt-to-GDP ratios within EM private sectors, along with the rapid growth in the issuance volumes of EM corporate bonds since the financial crisis, have caused several commentators to suggest that this growth may threaten economic stability in EM. On the whole, we believe this is incorrect, as the dynamics of the corporate bond market in the emerging world are not reflective of the rise in credit-to-GDP ratios. That is to say, that high credit growth has not necessarily occurred in countries where corporates have issued a large volume of bonds denominated in non-domestic currencies.

As with any corporate credit, the key to successful EM investment is choosing to lend to the correct companies at the right price. However, a strong understanding of the macro environment facing these companies adds significantly to this process and is especially relevant in EM. Understanding the distribution and growth of debt is key. Between 2012 and 2014, the top five countries for growth in domestic credit as a share of GDP were China, Malaysia, Turkey, Thailand and Russia – with China having the highest growth in the ratio at 22.5 percentage points (ppts) and Russia the lowest of the group at 17.5ppts. When we look at international bond issuance as a share of GDP, the top countries are Chile, Mexico, Peru, Brazil and Colombia, with a range of 2.7ppts to 7.5ppts. International borrowing is typically riskier than domestic borrowing due to currency mismatches and flightier capital. However, investors in EM corporate bonds can be comforted that many of the countries that have increased leverage have generally not made significant use of foreign capital to do it.

Two countries worthy of closer investigation are China and Turkey. Despite not issuing a large share of international bonds in GDP terms, China is still the most heavily represented country in EM corporate bond indices simply due to the size of its economy (especially when combined with Hong Kong). China has levered up more than any other country, to an extent that it dominates any analysis of aggregated emerging market credit markets. Chinese corporate bonds have famously experienced few defaults but nonetheless there are sure to be pitfalls here. Although, even within Chinese corporates, there are clear patterns in the way leverage has been used. Mainly, leverage is a feature of state-owned enterprises (SOEs) in heavy industries and local governments. However, the international bond market is mostly represented by banks, some higher-quality SOEs and also property developers, which are really a mixed bag in terms of quality. Recently, market leading technology firms have also issued debt.

In Turkey, international bond issuance by corporates has been rather limited, although the banks have been active issuers. Turkish banks have also borrowed from the international loan market and in shorter-dated funding markets such as repos and foreign exchange swaps. It is these operations that have driven the rise in the leverage ratio of the economy and this is what makes us cautious on Turkey. Credit growth has been huge here and the banks have taken far more risks with their funding mix than their peers elsewhere in the world. Given that banks make up three quarters of the available international bonds we prefer to stay underweight, especially given heightened geopolitical risks in the region.

Quality not quantity

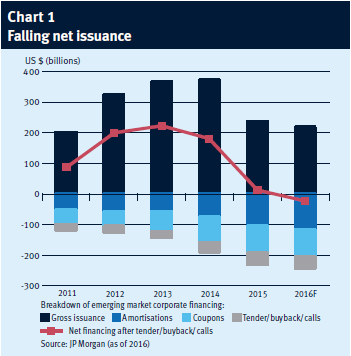

One factor in the macro environment that investors looking for returns could be interested in is that in much of EM there is currently a deleveraging process underway (see Chart 1). The top three countries by outstanding volume of bonds, China, Brazil and Russia, are all developing a trend of companies that tend to pay down their debt, either by a lower volume of issuance, or by buying back outstanding bonds. In Brazil and Russia, this has been occurring generally due to lower availability of financing, forcing companies to adjust their business models. However, in both cases they have been driving very strong returns this year as creditworthiness improves. Meanwhile, Chinese companies have ample access to domestic liquidity, while the depreciating yuan has been an incentive to pay down external debt. Despite no actual deleveraging, the technical effect on the market has been strong. Lower net issuance is likely to be a feature of EM corporate bond markets in the years ahead as maturities arrive and business models reflect the less aggressive growth assumptions made by companies. We believe this should bode well for investors.

One factor in the macro environment that investors looking for returns could be interested in is that in much of EM there is currently a deleveraging process underway (see Chart 1). The top three countries by outstanding volume of bonds, China, Brazil and Russia, are all developing a trend of companies that tend to pay down their debt, either by a lower volume of issuance, or by buying back outstanding bonds. In Brazil and Russia, this has been occurring generally due to lower availability of financing, forcing companies to adjust their business models. However, in both cases they have been driving very strong returns this year as creditworthiness improves. Meanwhile, Chinese companies have ample access to domestic liquidity, while the depreciating yuan has been an incentive to pay down external debt. Despite no actual deleveraging, the technical effect on the market has been strong. Lower net issuance is likely to be a feature of EM corporate bond markets in the years ahead as maturities arrive and business models reflect the less aggressive growth assumptions made by companies. We believe this should bode well for investors.

Disclaimer

This material is for informational purposes only and does not constitute an offer to sell, or solicitation of an offer to purchase any security, nor does it constitute investment advice or an endorsement with respect to any investment vehicle.

All information, opinions and estimates in this document are those of Standard Life Investments, and constitute our best judgement as of the date indicated and may be superseded by subsequent market events or other reasons.

Standard Life Investments (Hong Kong) Limited is licensed with and regulated by the Securities and Futures Commission in Hong Kong and is a wholly-owned subsidiary of Standard Life Investments Limited.

Standard Life Investments Limited is registered in Scotland (SC123321) at 1 George Street, Edinburgh EH2 2LL. Standard Life Investments are authorised and regulated by the Financial Conduct Authority.

www.standardlifeinvestments.com

© 2016 Standard Life, images reproduced under licence